Tax Levy Frequently Asked Questions

Did you know?

A property tax levy is the amount of property tax dollars a school district requests in order to educate the community’s children for the upcoming school year.

Essential Definitions:

- Tax Levy: The Revenue Requested by a public taxing body.

- Tax Extension: The Actual Revenue Received by the taxing body.

- PTELL (Property Tax Extension Limitation Law or “Tax Cap”): Limitation on the District’s Actual Revenue Received (or Extended) at the lessor of 5% or prior year consumer price index (CPI). The CPI that applies to the 2025 tax levy is 2.90%.

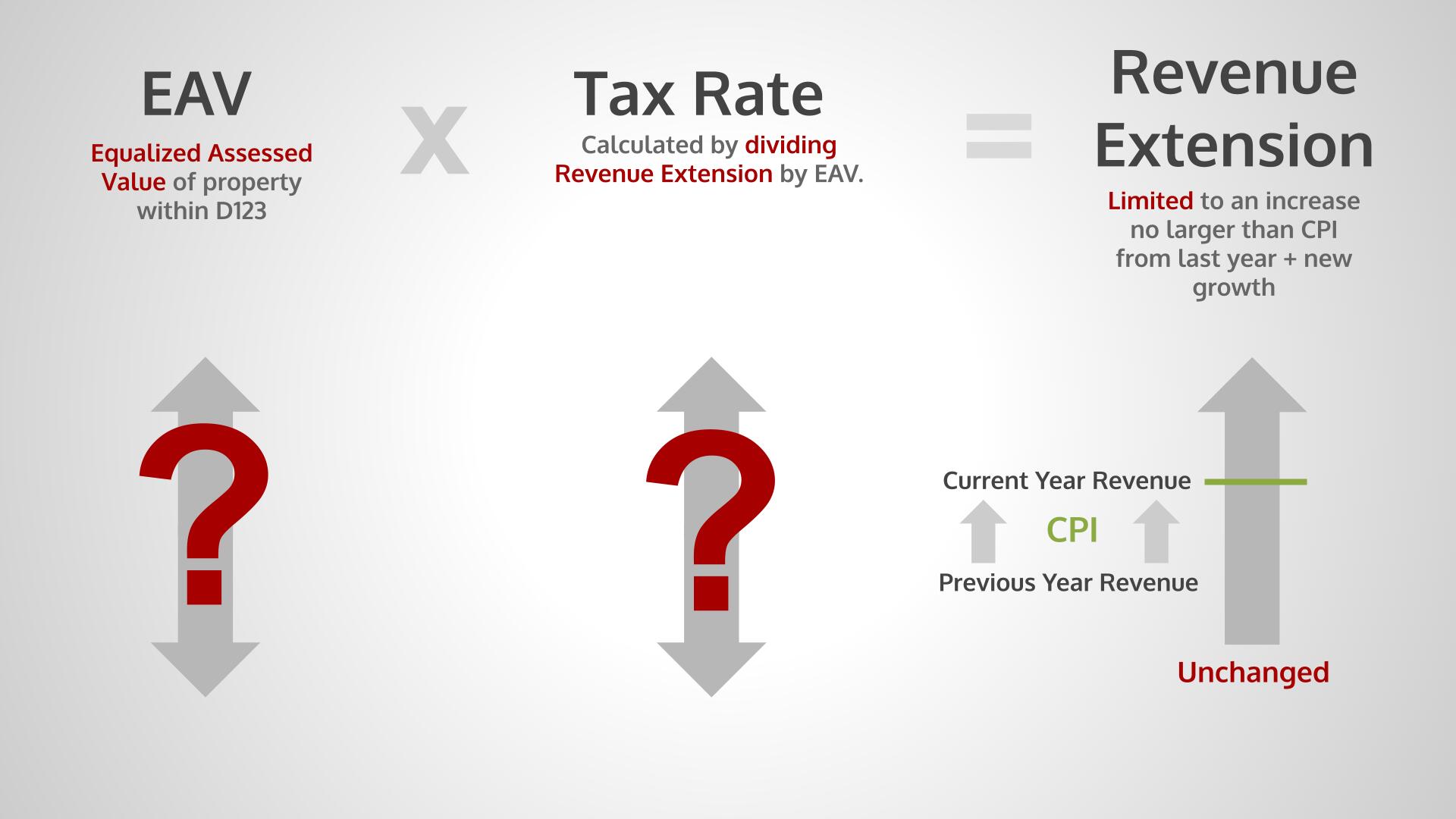

- EAV: Stands for Equalized Assessed Valuation, which is approximately 1/3 of the property market value.

- Tax Rate: Percentage applied to EAV to calculate the tax extension

How are property taxes calculated?

The basic formula takes EAV (including any new property growth in the district) and multiplies it by the tax rate. This equals the tax extension. This formula is difficult for taxing bodies to calculate precisely because two of the variables, the EAV and the tax rates are not available before the tax levy is due to be submitted to the Cook County Clerk’s office. Each year we make an educated guess to ensure we gather enough revenue to provide for the educational needs of District 123 students. The tax calculation can be illustrated by the graphic below.

Why would D123 raise taxes so much?

While the notice in the newspaper reports the tax extension to be 4.9% (or 4.23% including the debt service levy figure), the typical homeowners’ tax extension from D123 is capped at the lesser of 5% or the prior year's December Consumer Price Index (CPI) by law. This assumes the property has not changed from the prior year. District 123 is asking for an amount higher than that because we are anticipating new property (additions to the EAV) to enter the tax rolls that we want to capture. The actual new growth figures and property values will not be available until late spring of 2026, but our levy is due by the end of December 2025. To meet the December deadline we must make an educated guess regarding our overall tax extension.

What happens if D123 doesn’t levy enough?

If we guess wrong or otherwise miss the revenue target, we would be unable to receive the full amount of property tax we need to continue the programs and services essential to a high-quality school system. Since each year’s levy is calculated on the prior year’s extension, this mistake would be compounded each future year. About 70% of D123’s revenue is derived from local property taxes, so this mistake would be costly and detrimental to the students we serve.

What have the historical D123 tax levy % increases asked for versus tax extension limits?

2014: Levy Request: 4.94% – Levy Cap: 1.50%

2015: Levy Request: 4.04% – Levy Cap: 0.80%

2016: Levy Request: 4.13% – Levy Cap: 0.70%

2017: Levy Request: 4.17% – Levy Cap: 2.10%

2018: Levy Request: 4.00% – Levy Cap: 2.10%

2019: Levy Request: 7.81% – Levy Cap: 1.90%

2020: Levy Request: 3.42% – Levy Cap: 2.30%

2021: Levy Request: 3.44% – Levy Cap: 1.40%

2022: Levy Request: 5.75% – Levy Cap: 5.00%

2023: Levy Request: 6.03% – Levy Cap: 5.00%

2024: Levy Request: 4.93% – Levy Cap: 3.40%

2025: Levy Request: 4.99% -- Levy Cap: 2.90%

Posted on December 4, 2025

This site provides information using PDF, visit this link to download the Adobe Acrobat Reader DC software.